We’ll first turn to what looks like an accelerating rout in Bitcoin and other crypto currencies and then to what we see as potentially much more important, in terms of crisis risk, which is private debt market repricing driven by a reassessment of tech company risk.

Even investors who don’t much subscribe to technical trading use it (and more than you could possibly imagine, astrology) to help inform when and at what price level to act. Enough market players use it for it to have some influence. From what I can tell at a considerable remove, technical factors are even more important in the crypto realm, given the lack of fundamental value

As I was turning in, Bloomberg had an article entirely on this issue, describing how $67,000 was a critical price level for Bitcoin and what the next support levels would be if that threshold was breached.

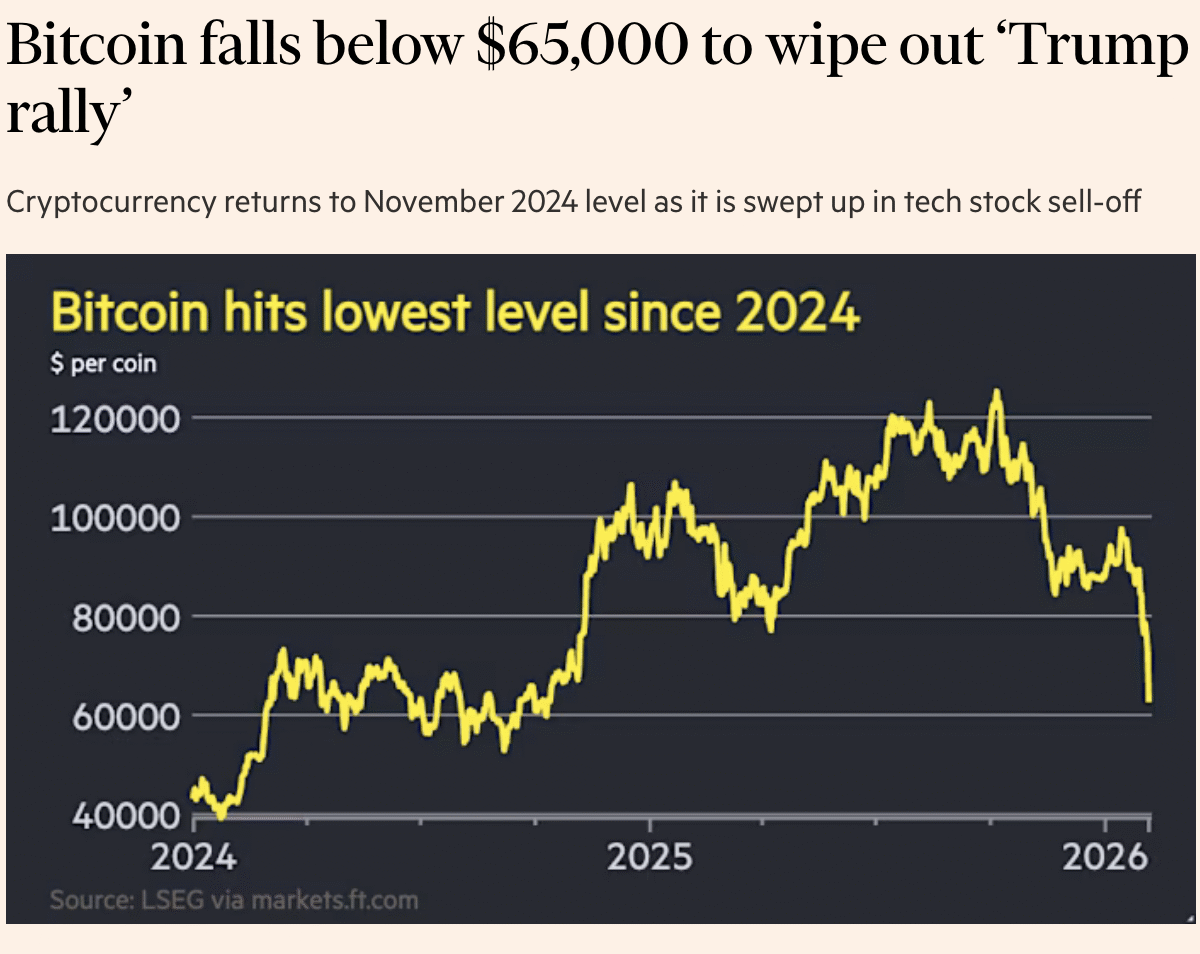

I see this morning my time that not only has Bitcoin fallen below that level, but the investor mood remains terrible. This morning I see:

Mind you, going back merely to 2024 levels for any investment should not be such a big deal…save for the part the headline makes explicit, that Trump had thrown his administration’s weight behind crypto boosterism. From the article:

Bitcoin sank below $65,000 on Thursday for the first time since 2024, wiping out all of the gains it had made since Donald Trump was elected to his second term as US president.

The world’s biggest cryptocurrency dropped 12 per cent to just below $64,000 as digital tokens were swept up in a sell-off in tech stocks. Bitcoin has lost more than a fourth of its dollar value this year.

“Sentiment has deteriorated sharply,” said Jasper De Maere, a strategist at trading firm Wintermute. “The crypto market still feels tired as we see little appetite from anyone to step in convincingly at these levels.”

Liquidations of leveraged bitcoin bets contributed to the downward spiral as traders who used significant leverage in their positions were forced to sell in order to meet margin calls — further depressing prices.

The price of ether, the second-largest coin, fell 13 per cent to $1,849, taking its decline this year to 37 per cent….

On prediction market platform Kalshi, traders began making bets last month on how low the price of bitcoin would fall this year. It shows a roughly 85 per cent chance that it will fall below $60,000.

And as for the argument that the energy cost of mining Bitcoin provided a price floor, that has gone into reverse:

The average cost to mine a single Bitcoin is now over $90,000. The price of Bitcoin has collapsed to $67,000. Everyone mining Bitcoin at the moment is losing a fortune. pic.twitter.com/oERwZCaPso

— Jake Broe (@RealJakeBroe) February 5, 2026

The pink paper points out that even though Trump did get some crypto-boosting legislation passed, other bills have stalled.

In early December, we described the role of levered Bitcoin players like Michael Saylor’s Strategy, misleadingly labeled as “Treasuries,” in accelerating a rout then. From that post:

We’ll soon discuss crypto “treasuries,” a cleverly misleading branding of entities that bought cypto and borrowed against it and then sold interests to investors as ETFs, giving them an all-too-easy way to turbo charge their crypto exposure. But let’s first look at the level of carnage.

“Since October 2024” ought not sound that bad….unless you were among the punters who added to Bitcoin or crypto positions since then.

LIKE, IF YOU ARE NOT SELLING #BITCOIN pic.twitter.com/uRb5F4kGMO

— Vivek Sen (@Vivek4real_) December 1, 2025

But all eyes are on the crypto treasury Stragegy. The lead story in Bloomberg Asia now:

From the text:

- Retail investors who invested in Michael Saylor’s Bitcoin experiment are paying a heavy price as Strategy Inc.’s shares plunged more than 60% from recent highs.

- The most popular exchange-traded funds tracking Strategy’s stock have dropped more than 80% this year, with the trio of MSTX, MSTU, and MSTP losing about $1.5 billion in assets since early October.

- Strategy Inc. has created a $1.4 billion reserve to fund dividend and interest payments, hoping to calm fears that it may be forced to sell Bitcoin if prices fall further.

Strategy Inc. — the company once hailed for wrapping crypto exposure into a public stock — is scrambling to calm markets after its shares plunged more than 60% from recent highs, amid a sweeping digital-currency rout. On Monday, Strategy said it had created a $1.4 billion reserve to fund dividend and interest payments, hoping to calm fears that it may be forced to sell Bitcoin if prices fall further.

But for many investors, the damage is already done. The most popular exchange-traded funds tracking Strategy’s volatile stock — MSTX and MSTU, which offer double the daily return — have both dropped more than 80% this year. That puts them among the 10 worst-performing funds in the entire US ETF market, out of more than 4,700 products currently trading — just behind obscure short bets against gold miners and semiconductor stocks. A third fund, known as MSTP, launched during the crypto mania in June, is down a similar amount since its debut. Together, the trio has lost about $1.5 billion in assets since early October…

At the center of concern is a valuation metric known as mNAV — or market net asset value — which compares Strategy’s enterprise value to its Bitcoin holdings. That premium has largely vanished, bringing the ratio to around 1.15 — a level executives have flagged as a warning zone. CEO Phong Le said on a podcast that slipping below 1.0 could force the company to sell Bitcoin to meet payout obligations, albeit only as a last resort.

The update from the Financial Times about Strategy has a whistling-past-the-graveyard feel:

Strategy reported a $12.4bn loss in the fourth quarter, which ended before the latest rout in bitcoin. Chief executive Phong Le said: “We’re not worried, and no, we’re not having issues.”

Notice the “paper gains,” with the Financial Times also saying “Bitcoin’s price drop has left the company with billions of dollars in paper losses”? I guarantee this is the doing of Strategy’s in-house PR person having beaten up on the Financial Times fact-checker to do whatever they can to soften how bad things look.

The Wall Street Journal published a story focused on Strategy’s woes. Key sections from Bitcoin Booster’s $12 Billion Loss Headlines Crypto’s Worst Day Since 2022 Crash:

Bitcoin tumbled to $63,596.56 at 4 p.m. Eastern time, sliding 13% during its worst 24-hour trading period since June 2022. Minutes later, Michael Saylor’s Strategy MSTR -17.12%decrease; red down pointing triangle said crypto’s late-2025 swoon had left the bitcoin-stockpiling company with a staggering paper loss in the fourth quarter.

Strategy’s fourth-quarter net loss widened to $12.4 billion, or $42.93 a share, from $670.8 million, or $3.03 per share, a year earlier. In the most recent period, the company recorded an unrealized fair-value loss of $17.4 billion on its digital assets, complying with accounting rules that require companies to value their holdings at current market prices.

An update from Bloomberg. Bitcoin swooned further to just above its support level, then bounced:

Bitcoin fell as much as 4.8% to a fresh low of $60,033 on Friday morning, then bounced back to $66,721, up roughly 5.8% for the session. The token had briefly more than halved in value from an all-time high on Oct. 6 of over $126,000, and other tokens also fell sharply before rebounding. Traders are now focused on whether Bitcoin can hold $60,000, with a failure to do so potentially seeing downside in the mid-$50,000 range.

I am not a technical trader, but isn’t that $67,000 once hoped-for floor now resistance on the upside?

The bigger question is whether crypto is about to enter a period of longer-term revulsion. It took twenty years for stocks to get back to their pre-Great Crash levels. Stocks were also very much in disfavor in the later 1970s and start of the 1980s, witness the famed Business Week Death of Equities cover.2

The bigger question is whether crypto is about to enter a period of longer-term revulsion. It took twenty years for stocks to get back to their pre-Great Crash levels. Stocks were also very much in disfavor in the later 1970s and start of the 1980s, witness the famed Business Week Death of Equities cover.2

In the meantime, Twitter is full of delicious schadenfreude. A tiny sample:

This Bitcoin crash is worse than a divorce

I lost half of my money and my wife is still around pic.twitter.com/0wyoAFaCiz

— Bitcoin Teddy (@Bitcoin_Teddy) February 5, 2026

I am generally not a fan of engagement algorithms except when bitcoin is crashing. Then HOOK IT TO MY VEINS

— Matt Stoller (@matthewstoller) February 5, 2026

Remember when the bitcoiners were telling us that bitcoin would eliminate wars and usher in global peace?

Die hard bitcoiners are basically goldbugs with a lobotomy

— Dow (@mark_dow) February 4, 2026

Looks like it’s time to start tweeting the Bitcoin chart on a log scale…

— Tracy Alloway (@tracyalloway) February 5, 2026

More substantively:

Because it’s a Ponzi scheme and the insiders are dumping it. There is no natural use case or need for Bitcoin. It is a control fraud. https://t.co/V5R74ZraO1

— Jesse’s Cafe (@JessesCafe) February 5, 2026

Actually, on the point of Bitcoin and crypto having no use case, as much as I very much like and respect Jesse (we were running buddies back in the financial crisis days), they do. But they are not socially productive. In addition to the oft-mentioned tax evasion, money-laundering, and criminal payoff situations, former State Department official Mike Benz has said that a major user in total transaction volume are intel agencies, for payoffs to recently recruited assets and to otherwise move funds covertly to support things like regime change operations. So that alone suggests these, erm, vehicles1 will not go to zero since they have an official use.

Izabella Kaminska’s hidden history reinforces that idea (do click through to read in full):

1/2 🧵There’s a very compelling theory that the person who really bankrolled the foundations of bitcoin (irrespective of who technically wrote the paper and coded it) was mob boss Meyer Lansky.

If you don’t know who Meyer Lansky is, you should look him up.

I’ve always found…

— Izabella Kaminska (@izakaminska) February 5, 2026

Keep in mind that despite all the drama, unless there is a lot more leverage in crypto-land than most of us knew about, its decline (and possible rally) is not systemically important, but more a canary in the coal mine as a sign of how much markets react in a time of radical uncertainty. Thank you Trump!

Repeat after me: it is untenably high levels of private debt that produce financial crises.3 The US is at a troubling nearly 2x GDP. As bad is that many tallies show China at nearly the same ratio. China-watcher PlutoniumKun contends that this means if anything, the proportion is even higher, and from what he can tell, exceeding even Japan’s level before its joint real estate/stock market implosion. And China, like Japan at the start of its lost decades, is entering a deflationary dynamic, which will worsen the real economy effects of its debt overhang.

Even if China is adept enough not to suffer an overt financial crisis, its big debt overhang means it will be exceedingly unlikely to engage in the aggressive stimulus it launched after the 2008 crisis, which greatly blunted the global impact. So a crisis in the US will probably not have any meaningful offset overseas.

The Wall Street Journal reports that investors are demanding higher interest rates for borrowing by big tech players. This matters for many reasons. One is that many of these debtors were already in risky category. The pattern in financial crises and in mere downturns is that lower-quality credits reprice first. Then if things continue to get worse, investors demand more yield from better borrowers.

In this case, there’s an important knock-on effect. What passes for growth in the US has become increasingly depending on big tech spending on AI and data centers. And these companies were planning to fund that capex with borrowing.

From The Software Rout Is Spreading Pain to the Debt Markets:

The steep selloff in software stocks is spreading to the debt market….

That expanding pain is worrying many on Wall Street, because software has come to assume an outsize presence in the corporate-debt market—the result of a wave of private-equity buyouts that stretched from the late 2010s through the early 2020s. A downturn in the sector has the potential to drag down other areas of the market, cooling what has been a humming credit engine.

Software currently makes up 13% of the Morningstar LSTA U.S. Leveraged Loan Index—which tracks speculative-grade loans that are originated by banks and broadly distributed to investors—more than double the share of the next largest sector. The sector makes up an even larger percentage of private-credit loans made by asset managers directly to companies, with estimates putting the share at around 20% to a third of those loans.

Since mid-January, the prices of loans issued by the likes of Cloudera, a data analytics company, and Qlik, the maker of business intelligence software, have sunk by around 10 cents on the dollar or more, according to S&P Global Market Intelligence. Overall, the average price of software company loans in the Morningstar LSTA index has dropped to 90.51 cents on the dollar, as of Wednesday, from 94.71 cents at the end of last year, according to PitchBook LCD.

A 10% move in the credit markets is big. CLO prices (as in tranched corporate loans; unlike CDOs, they have better diversification and structures and have performed well over time) fell to 85 cents on the dollar during the worst points of the crisis and stayed there for a while.

Back to the Journal. Investors are concerned about rollover risk, which in most cases is years away:

Many software-company loans will mature in just a few years, and investors and analysts say there is little indication that AI is hurting the companies right now. Still, businesses typically repay maturing loans with money raised from new loans.

That means if investors are holding a loan that matures in 2028, they have to be confident now that there will be a new lender at that time “that is confident in at least another five years,” said Michael Anderson, global head of credit strategy at Citigroup.

However, there is also a more general repricing:

Throughout the 1990s and early 2000s, debt investors largely avoided tech companies because they thought of them as either home runs or strikeouts. That meant they could be good for shareholders, who could reap the rewards from the successes, but bad for lenders, whose best-case scenario was regular coupon payments, and who ran the risk of significant losses in bankruptcies.

Attitudes shifted in the 2010s, with the growth of high-speed internet, cloud computing and subscription-as-a-service business models, which offered the promise of predictable revenue streams. Investors came to view the sector as so stable that they were willing to fund private-equity buyouts that loaded companies up with more debt than other types of businesses.

Even before AI worries emerged, some software companies had started to look more vulnerable, thanks in part to the 2022 jump in interest rates and rising competitive pressures…

Some analysts say there is at least some potential for trouble in the software sector to spill into other areas of the loan market.

In comments, reader Uday Yadati observed:

The structural issue here is about the erosion of the switching cost moat that justified these loan-to-value ratios. For a decade, lenders treated SaaS revenue as bond-like, assuming high switching costs made leaving impossible. That stickiness was the collateral.

Gen AI automates migration and commoditizes code, dropping switching costs. This transforms recurring revenue into volatile spot revenue. It’s hard to justify 6x leverage on spot dynamics. The market is simply stripping away the predictability premium.

In other words, software and big tech companies will have not just to pay higher interest rates than before, but will see other terms tighten, such as leverage ratio. This translates into more costly and less available credit, which will dent their AI spending and data center buildout plans. How quickly this will ploy out is anyone’s guess, but it’s another sign that the “AI inevitability” story runs into real world constraints, even before getting to credit crunch risks. Stay tuned.

____

1 Lambert regarded the use of the term “vehicle” with respect to fancy finance as truth in advertising: “They drive away with all your money.”

2 Very few investors appreciate how public stocks are a very vague and weak legal promise. You get dividends if and when the company makes money and feels like paying them. You have a vote on comparatively few matters that can be diluted at any time. Even with the appearance of extensive disclosure, it is inadequate to make informed decisions. Companies cannot tell you much about their strategies and plans because it is competitively sensitive.

3 High levels of official debt are most often “addressed” via financial repression. However, given how self-and-other destructive the Trump Administration has proven to be, it is not impossible that they will shoot themselves and the world economy in the head by a voluntary default on Treasuries via force extending maturities.